Готовые презентации на тему:

- Образование

- Искусство и Фото

- Наши презентации

- Авто/мото

- Технологии

- Бизнес и предпринимательство

- Карьера

- Данные и аналитика

- Дизайн

- Устройства и комплектующие

- Экономика и Финансы

- Машиностроение

- Развлечения и Юмор

- Путешествия

- Eда

- Политика

- Юриспруденция

- Здоровье и Медицина

- Интернет

- Инвестиции

- Закон

- Стиль жизни

- Маркетинг

- Мобильные технологии

- Новости

- Недвижимость

- Рекрутинг

- Розничная торговля

- Таможня, ВЭД, Логистика

- Наука

- Услуги

- Программное обеспечение

- Спорт

- Музыка

- Шаблоны презентации

- Детские презентации

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- История

- Литература

- Информатика

- Математика

- Обществознание

- Русский язык

- Физика

- Философия

- Химия

- МХК

- ОБЖ

- Окружающий мир

- Педагогика

- Технология

- Начальная школа

- Раскраски для детей

- Товароведение

- Менеджмент

- Страхование

![IO and policymaking

For policy makers:

Competition policy aims to prevent firms from abusing market power. [Sherman Act 1890, China antitrust law 2007]

How to measure market power and excess profit?

How competitive is a specific industry?

What types of firm behavior can make an industry less competitive?

What type of market structure is most conductive of innovation?](/documents_6/4762e2e004719698dc859a55d488b38f/img5.jpg)

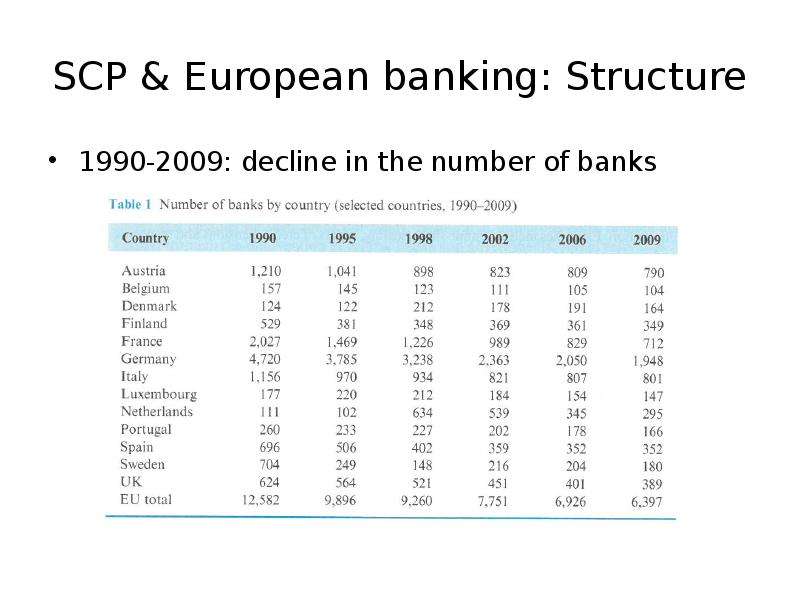

![SCP & European banking: Structure

1980s: European banking was fragmented. Banks did not operate in other countries [high entry barriers]. Domestic banks did not face competition from foreign banks.

Deregulation made EU banking more competitive

Second Banking Directive, 1990

Creation of the euro

As a consequence: Banks able to trade throughout Europe.

Lowered entry barriers.

Do this make the industry more competitive or less competitive?](/documents_6/4762e2e004719698dc859a55d488b38f/img15.jpg)

![Competition policy and SCP

Structure Conduct Performance

Public policies that aim to prevent the abuse of market power

Preventing mergers beyond a certain scale [STRUCTURE]

Price controls, restrictions on collusion [CONDUCT]

Policies that also affect firms’ PERFORMANCE](/documents_6/4762e2e004719698dc859a55d488b38f/img21.jpg)

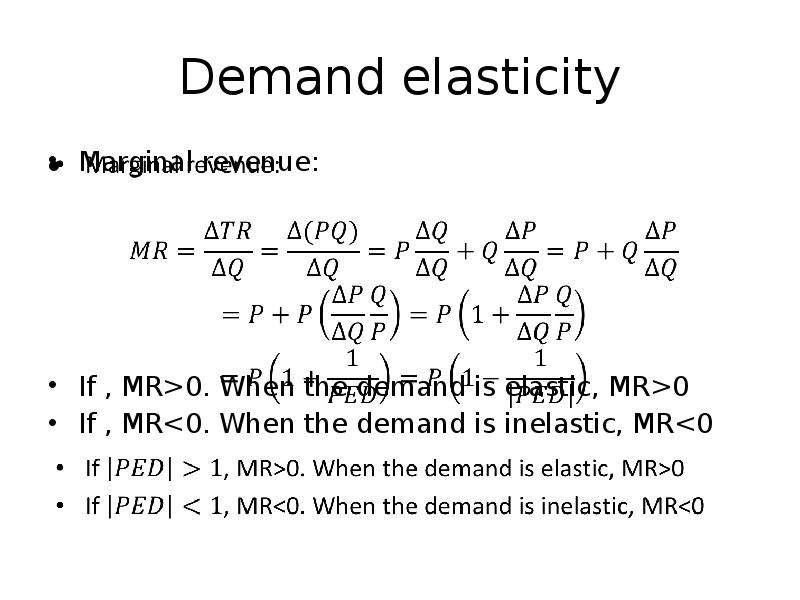

![Demand elasticity

Price elasticity of demand:

Note that PED<0

If , the revenue decreases as P increases. [elastic demand]

If , the revenue remains unchanged as P increases.

If , the revenue increases as P increases. [inelastic demand]](/documents_6/4762e2e004719698dc859a55d488b38f/img42.jpg)